These New Rules for Bank Transfers Will Soon Come Into Effect

On October 9, the rules for transfers will change. Real-time transfers will become the standard and must be offered by banks within the Eurozone. Additionally, there are new security measures: In the future, the bank will check before completing the transfer whether the IBAN and the recipient's name match. This is intended to better combat fraud. Consumer protection advocates view the changes primarily positively.

AK Views IBAN and Recipient Check Positively

"Basically, it's a good thing because financial fraud in the banking sector has increased significantly," says Christian Prantner, consumer protection expert at the Chamber of Labor (AK), in an interview with APA. Until now, it has been easy for fraudsters to redirect payment flows because the IBAN and the recipient's name did not have to match - the IBAN was the only customer identifier. Fraudsters could provide false account details along with the name of a legitimate payment recipient, and the transfer would go through without any issues.

However, retrieving an incorrect or faulty transfer is usually not possible and can be costly for customers, says Prantner. If a transfer is carried out unintentionally or goes wrong, you can place a trace request with the bank. However, this costs - according to Prantner, the institutions charge between 30 and 50 euros for this.

Traffic Light System for IBAN Matching Planned

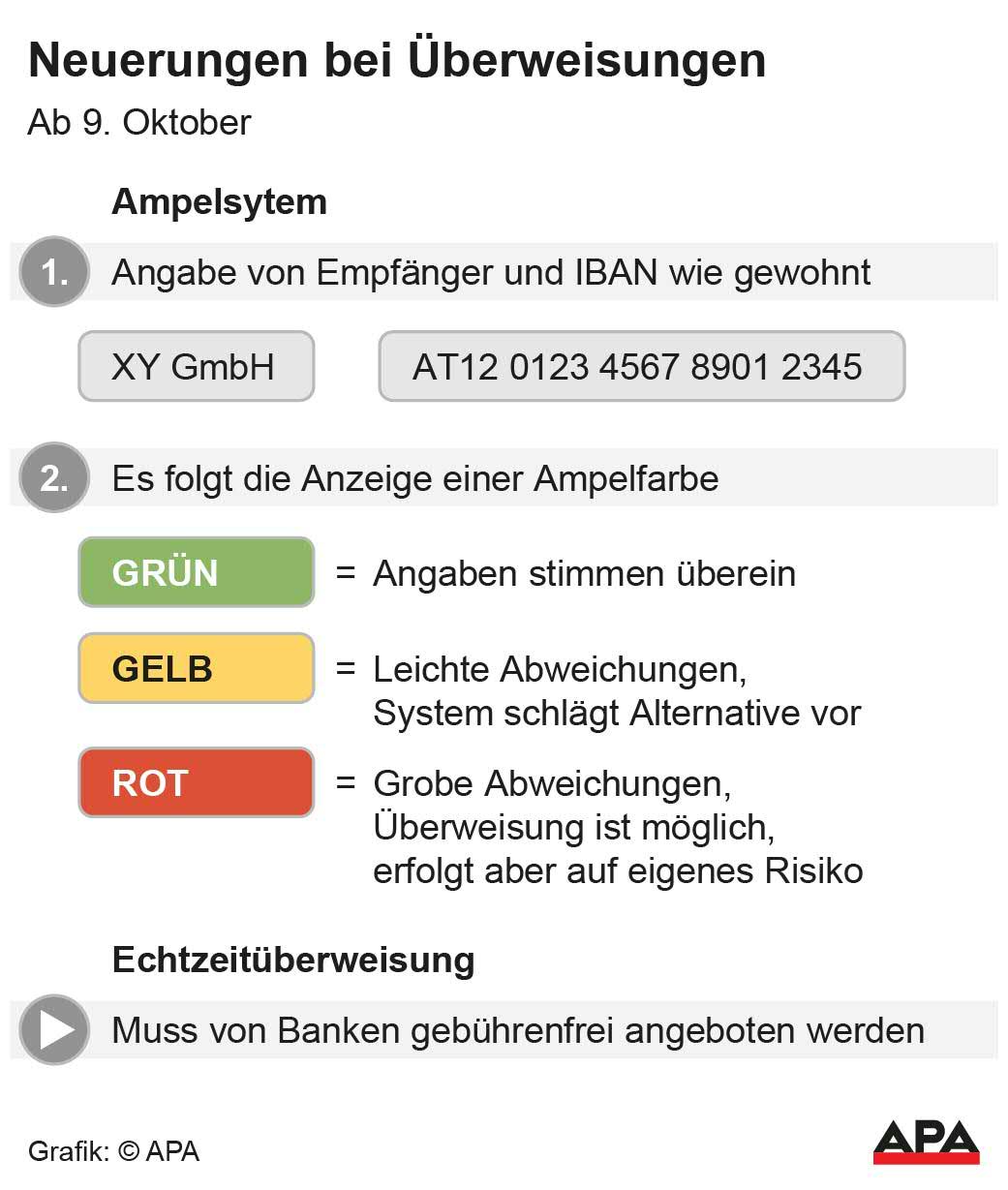

To counter the increasing fraud cases, the mandatory IBAN name matching will be introduced from October 9. A kind of traffic light system is planned for this. It checks before the customer approves the transfer whether the IBAN and the recipient's name match. If the two parameters match, the bank gives the green light for the transfer. If there are slight deviations (yellow), such as a typo in the recipient's name, the system suggests the correct name. In the case of significant discrepancies between the IBAN and the name, the transfer is flagged (red). Approval of the transaction is then possible, but it is at the customer's own risk, and in the event of an error, the bank assumes no liability.

In addition to the IBAN matching, all banks must offer real-time transfers for transactions within the Eurozone from October 9. The classic SEPA payment will thus be virtually replaced. Additional fees may not be charged for a real-time payment. The basis of the changes is the EU's "Instant Payments Regulation."

Changes Bring More Personal Responsibility for Customers

For customers, Prantner primarily sees positive changes, as incorrect transfers are better prevented through the matching. "This does bring a new level of security." However, this also results in more personal responsibility for customers, who now have to take greater responsibility for ensuring that the transaction is carried out correctly.

If a transfer raises a red flag, the AK expert advises taking a "big step back" and carefully checking the entered data again. The bank is only liable for incorrect transfers if the previous check (erroneously) showed that the name and IBAN match. Customers should therefore ideally take the recipient's name directly from the received invoice when shopping online. If unsure, one should always check with the merchant before releasing a payment.

Additionally, transfer limits can be set for each account - this would also be a sensible measure for Prantner to prevent incorrect transfers. In general, customers should use the transition to review their account settings, advises the AK expert.

Real-Time Transfers Could Accelerate Fraud

The innovations also carry risks. "Real-time transfers also accelerate fraud," said the AK expert. There is a potential risk that in the event of fraud, payment flows are much more difficult to trace and the money is therefore harder to recover.

The increasing speed in payment transactions is not always positive for customers themselves. "I see many customers who are overwhelmed by the increasing digitalization," said Prantner. There is significant digitalization pressure on banks, while more and more branches are disappearing. Bank customers also frequently complain about a lack of support, as often no "real" advisor is reachable by phone.

Furthermore, the AK wants to "closely monitor" whether the new regulations around IBAN matching will lead to rising fees in payment transactions in the medium term. Prantner refers to the AK Bank Monitor, which regularly compares the fees of domestic institutions.

Further Regulation for More Fraud Protection in Progress

According to the AK expert, there is still much more to be done in combating fraud in the banking sector - especially when it comes to phishing. In this context, another regulation is being developed in the EU - the Payment Services Regulation. This primarily concerns liability provisions for banks - these currently often disadvantage customers and need to be improved. With the new regulation, banks would be "held more accountable," said Prantner. However, it is difficult to estimate when the new regulation will come, as the trilogue between the Commission, Council, and Parliament has not yet begun, according to Prantner.

(APA/Red)

This article has been automatically translated, read the original article here.