Palmers is Insolvent and Files for Reorganization Proceedings

The aim of the reorganization procedure is to ensure the continuation of operations, according to Palmers in a statement. The insolvency had to be filed "because necessary capital inflows did not occur in a timely manner," said Palmers. "For a positive continuation forecast by the end of January 2025, significant liquid funds would have been necessary in a timely manner." Other reasons for insolvency, according to the creditor protection associations KSV1870 and AKV, were strong competition, a saturated market, rising interest rates, and inflation, which led to a loss of purchasing power. The liabilities amount to around 51 million euros, according to the company, while the assets amount to 11.50 million euros, according to AKV. KSV and AKV estimate the number of affected creditors at around 500.

Palmers No Longer Accepts Voucher Coins

"Voucher coins are no longer accepted," a Palmers spokesperson told APA. The reason is the protection of creditors. "Vouchers - and the coins are nothing else - are a certified claim against a company. If this company becomes insolvent, as in the case of insolvency, it is legally prohibited from favoring or disadvantaging the voucher holders," said AK consumer protection advocate Kirstin Grüblinger to the "Kronen Zeitung" on Thursday. Consumers can, however, register unredeemed vouchers as a claim in the reorganization procedure. This costs 25 euros per registration.

Palmers Believes in Successful Talks with Investors After Insolvency

To emerge from insolvency, Palmers needs a new investor. The search has been ongoing for some time, but no one could be found quickly enough to participate in the financing. Already in the minutes of the general meeting at the end of January, there was talk of a potential investor, but without specific details on who it might be or what stake they might take in the company. Without an investor, it will likely be difficult, believes Karl-Heinz Götze from KSV. "It will very likely not be possible without a new investor," said Götze in the Ö1 midday journal. No further details on potential investors were disclosed in today's release, but talks are ongoing. Palmers is confident that these can be successfully concluded in the medium term. Götze shares this assessment: "Palmers is a very strong brand, very well known in Austria. I can very well imagine that interesting investors can be found here."

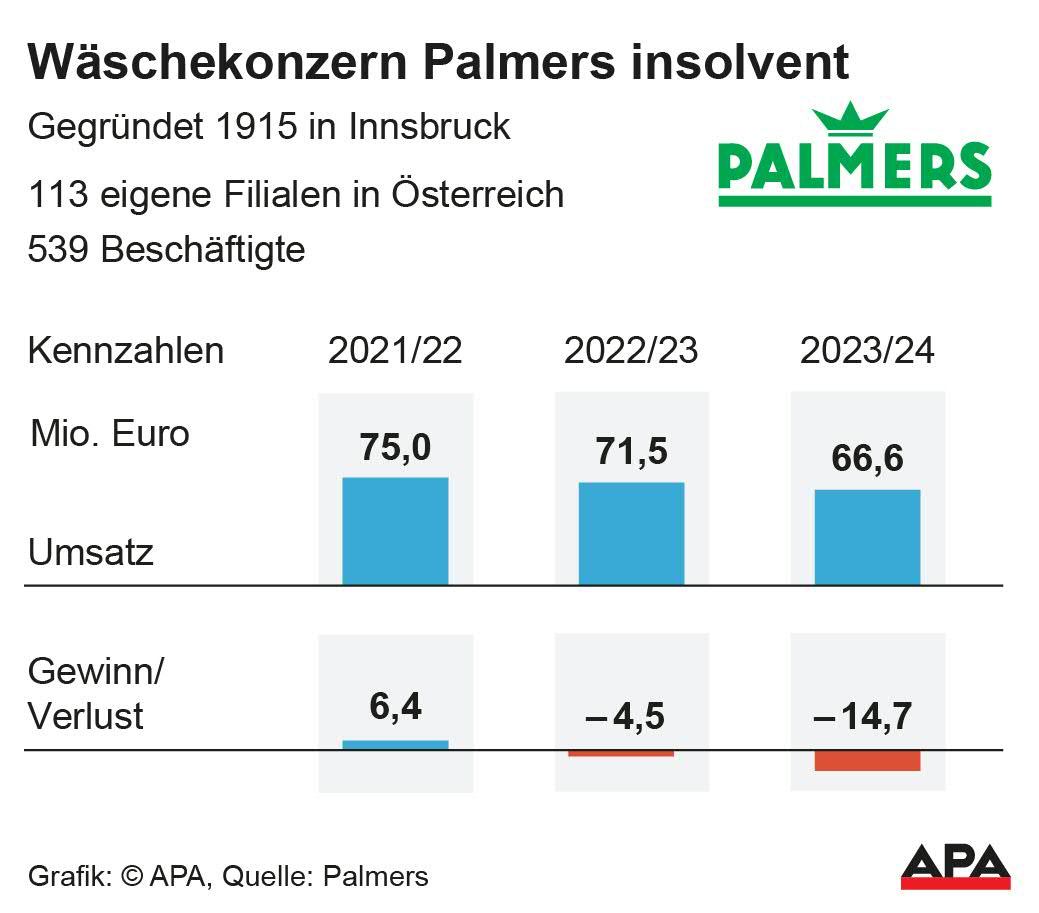

The reorganization is also intended to "bring the company back on the road to success." The restructuring and reorganization measures started last year, aimed at reducing costs, increasing profitability, and repositioning the brand, will continue to be pursued by Palmers. It was announced at the time that the number of branches would be reduced from 120 to 100. Currently, the company still has 113 own branches and 539 employees in Austria. Additionally, there are 35 branches operated on a franchise basis that are not affected by the insolvency.

No Immediate Cuts to Palmers Staff or Locations

In addition to the already announced reduction of 20 branches, no further locations are expected to be cut as part of the restructuring, according to the company spokesperson. Personnel is also not expected to be reduced for the time being. So far, the employment relationships of the employees continue as normal, the GPA union announced on Thursday. On Friday and Monday, employees are to be informed about further steps in online company meetings.

At the beginning of February, the company had "provisionally" registered layoffs with the early warning system of the Public Employment Service (AMS), but at the same time it was announced that it was not yet clear whether and to what extent there would be job cuts. However, there have already been problems with the payment of salaries, as wages and salaries have been outstanding since January. Palmers is in contact with employee representatives and is "working intensively on a timely payment of the outstanding salaries for the more than 500 employees through the insolvency compensation fund," according to the company.

Palmers Recorded a Loss of 14.7 Million Euros in 2023/24

In the 2023/24 fiscal year, the loss more than tripled to 14.7 million euros. Revenue fell from 71.5 million to 66.6 million euros. Mid-year, Palmers also needs to refinance high million-euro loans. "A key assumption for the positive going concern forecast is the negotiation of the loans due on 30.6.2025 amounting to 14.418 million euros (COFAG)," it was stated in the company's annual report in the fall.

Palmers was founded in 1914 by Ludwig Palmers in Innsbruck and gained attention from the 1950s onwards, especially through its billboard advertising. Palmers was family-owned until 2004, then belonged to financial investors like the German fund Quadriga until 2015, and now to the brothers Luca and Tino Wieser as well as Matvei Hutman.

Palmers caused a scandal during the coronavirus pandemic when the company, together with the fiber manufacturer Lenzing, entered the business for FFP2 masks but labeled masks from China as "Made in Austria." Last fall, Palmers sought fresh money from small investors. Financing problems were still denied at that time.

(APA/Red)

This article has been automatically translated, read the original article here.