OMV Posted a Hefty Profit Last Year

"After the exceptional years 2022 and 2023, we achieved the fourth-best result in the history of OMV in 2024," said OMV CEO Alfred Stern on Tuesday at the balance press conference in Vienna. "In a difficult environment, we operated very profitably, even though we did not quite reach the result of the strong previous year 2023."

Decreased Commodity and Energy Prices Affect OMV Business

Falling commodity and energy prices, along with a weak economy, significantly influenced OMV's business last year, Stern reported. At the same time, the chemical division recovered somewhat from the very weak year 2023. The average Brent crude oil price of 85 dollars (82.73 euros) per barrel was 2 percent below the previous year. Wholesale gas prices fell by 16 percent to an average of 35 euros per megawatt hour. In the refinery business, the OMV refinery reference margin in Europe reached 7.1 dollars per barrel compared to 11.7 dollars in 2023. However, the polyolefin business recovered with significantly improved margins, Stern reported.

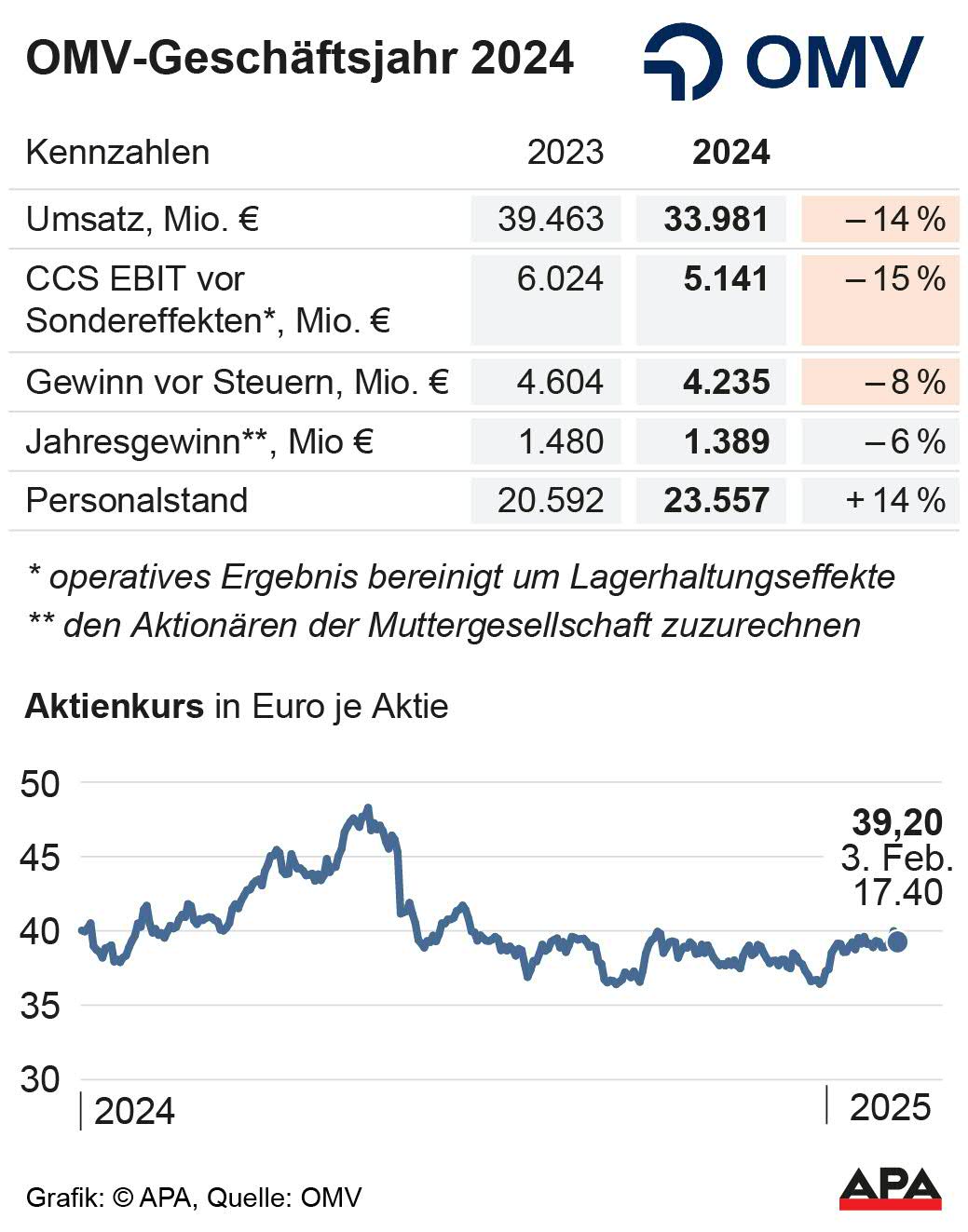

In total, OMV achieved a group turnover of almost 34 billion euros (minus 14 percent) in 2024, with a cash flow from operating activities of 5.31 billion euros (plus 14 percent). The CCS operating result before special effects (adjusted mainly for valuation effects on inventories) fell by 15 percent to 5.14 billion euros. The CCS net income attributable to shareholders before special effects fell by 19 percent to 2.09 billion euros, the earnings per share (EPS) from 4.53 to 4.25 euros. The annual surplus attributable to shareholders fell by 6 percent to 1.389 billion euros - although this figure was significantly better in the final quarter at 301 million euros (plus 28 percent).

Dividend Drops to 4.75 Euros per OMV Share

The board proposes a dividend of 4.75 euros per share, consisting of a regular dividend of 3.05 euros and a special dividend of 1.70 euros. A total dividend of 5.05 euros per share was paid out for 2023. This year, OMV plans investments of 3.6 billion euros. The total production of oil and gas is expected to be around 300,000 barrels per day, provided there are no disruptions to production in Libya. The production costs at the group level are expected to rise from 10 to 11 dollars per barrel. The average Brent crude oil price is estimated at 75 dollars (73 euros) per barrel for this year, the average realized natural gas price at around 35 euros per megawatt hour. The utilization rate of the refineries is expected to be between 85 and 90 percent.

OMV Expects Falling Oil Prices

This year, OMV expects a further decline in the Brent oil price to an average of 75 dollars. The average German gas wholesale price (THE) is expected to rise to 40 to 45 euros per MWh. "The average wholesale price in 2024 was a third to a quarter compared to 2022, but still higher than before the Russian attack on Ukraine." With the exit from the long-term gas supply contract with Gazprom, "we are opening a new chapter in the company's history," said Stern. It is important to get more gas to Europe to lower prices, Stern said. The price mechanism in Europe has changed. "Previously, pipeline gas from Russia could not flow anywhere else, but LNG ships can go where the best price is paid."

OMV Wants to Drive Its Own Gas Production

Therefore, we need to drive our own production in Europe. "Also in Wittau, where we have made Austria's largest gas find in 40 years, we want to fully exploit the potential of the field." We expect that we can increase gas production in Austria by 50 percent. The first drilling operations are expected to begin this year at the Neptun Deep project in the Black Sea in Romania. The reserves that can be produced there are estimated at 100 billion cubic meters. There, we will produce at a level of 7 to 9 billion cubic meters per year for about ten years. This corresponds approximately to the annual demand in Austria.

As for the talks between OMV and its core shareholder ADNOC (Abu Dhabi National Oil Company) about a joint venture of the OMV chemical subsidiary Borealis with Borouge in Abu Dhabi, which have been ongoing since mid-2023, OMV continues to report only the bare minimum. A few days ago, it was announced that they are now also considering the purchase of the company Nova Chemicals, which, like ADNOC, belongs to the Emirate of Abu Dhabi.

(APA/Red)

This article has been automatically translated, read the original article here.