Mouth and Foot Disease Would Hit Local Dairy Farmers Hard

According to the president of the Milk Association, Helmut Petschar, Austrian milk processors achieved a revenue increase of 1.7 percent to 4 billion euros in 2024. However, the recent outbreak of foot-and-mouth disease (FMD) in Slovakia and Hungary poses a serious threat to the industry.

Exports from domestic dairy farmers would suffer under foot-and-mouth disease outbreak

If an FMD case were to occur in cows in Austria, the dairy industry would be enormously affected, said Association President and Kärntnermilch CEO Petschar. Other countries would then stop importing dairy products from Austria for a certain period, even though pasteurized milk and the dairy products made from it pose no health risk to humans. There is a lot at stake for Austrian dairies in terms of exports: last year, exports of domestic dairy products increased by 3 percent to 1.8 billion euros. After the FMD cases in the eastern neighboring countries in March, there was uncertainty among foreign dairy customers, Petschar said at a press conference in Vienna on Tuesday. However, this was clarified, and exports would continue as normal.

Milk price paid to farmers remains high

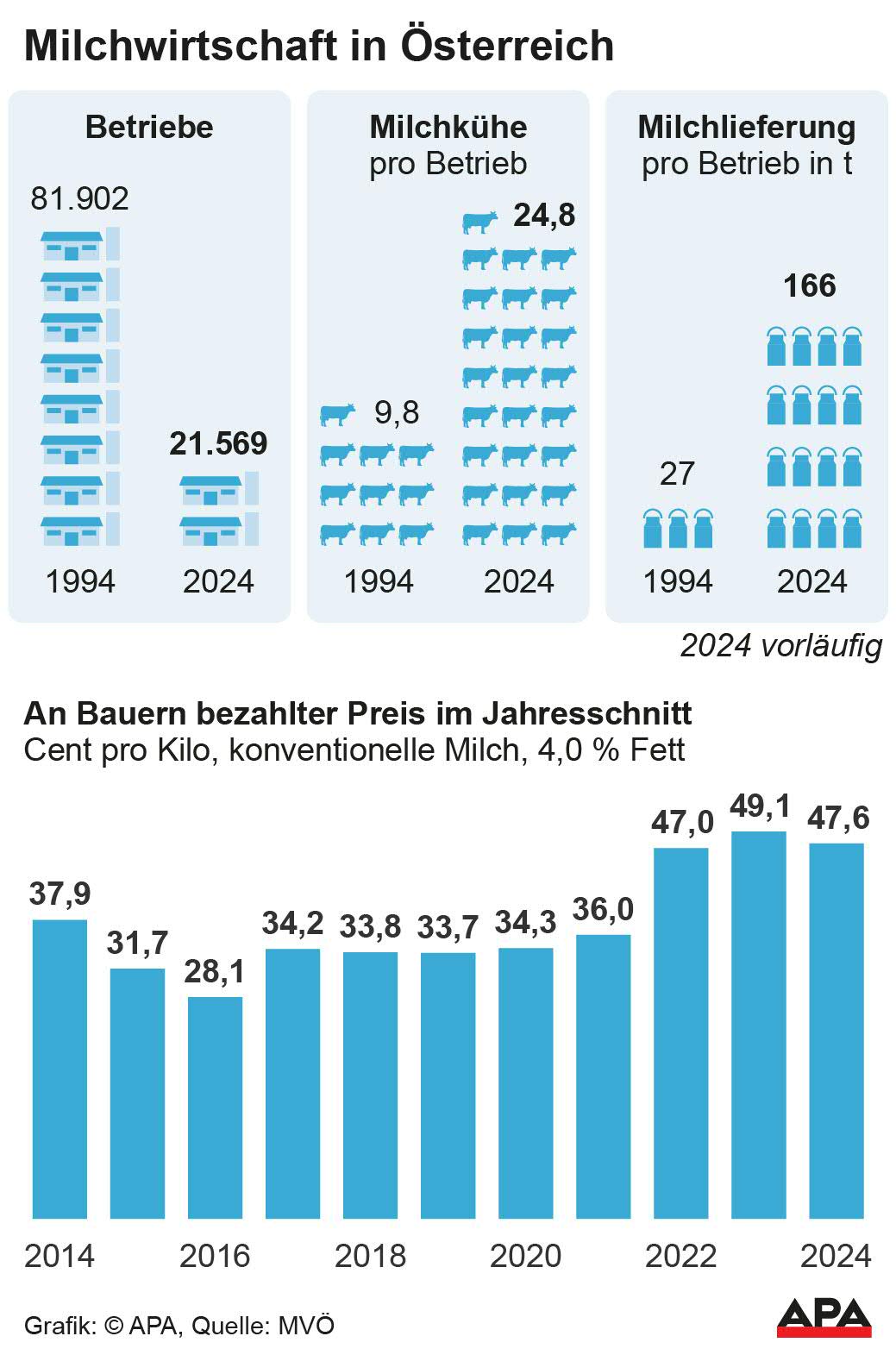

The producer milk price paid to farmers has stabilized after the milk price crisis of 2015/16 and has been at a high level since 2022. The producer price for conventional milk with 4 percent fat averaged net 47 cents/kilogram in 2024, down from 49 cents the previous year. In comparison, it was only 28 cents in 2016. Farmers recently received a premium of 3 cents for hay milk and 7 cents for organic milk. The average milk payment per supplier paid out by dairies increased by 2.4 percent to around 94,450 euros in 2024, and the delivery per supplier increased by 5.3 percent. Due to increased costs, the earnings situation of the dairies is "very minimal," according to the Milk Association President.

Around 60,000 dairy farmers have quit since EU accession

Since Austria's accession to the EU in 1995, there has been a massive structural change in the domestic dairy industry. In 1994, there were nearly 82,000 dairy farmers in Austria, but by 2024, there were only 21,569. Compared to 2023, the number of milk suppliers decreased by 850 or 3.8 percent. The number of dairy cows per farm increased from 9.8 to 24.8 between 1994 and 2024, and the annual milk delivery per farm surged from 27 to 166 tons per farm over the last 30 years. Many part-time dairy farmers have quit over the past three decades. The Milk Association President expects a further decline in the number of dairy farmers in the coming years because young people do not want to take over their parents' agricultural operations.

The price negotiations between the four major food retailers Spar, Rewe (including Billa), Hofer, and Lidl, with a market share of over 90 percent, and the dairies are becoming "increasingly brutal," according to industry representative Petschar. The partially publicized delivery dispute between NÖM and Spar from October 2024 to February 2025 caused a stir. Despite the relatively high producer milk prices for farmers, the milk quantity has not increased significantly in recent years. "In the future, it will be about supply security." The trade is "well advised" to "consider" the economic situation of the dairy farmers.

Milk Association Managing Director Johann Költringer pointed out that dairy products were "not inflation drivers" in 2024. In Austria, consumer prices for dairy products have become nominally cheaper overall. Petschar hopes for support from the new government for the quality and sustainability strategy of the dairy industry. The association continues to push for a dairy product origin labeling in processed foods and in gastronomy.

(APA/Red)

This article has been automatically translated, read the original article here.