Austria Lost 1,000 Organic Farmers Since 2022

Consumers purchased more organic products in the domestic grocery retail sector last year and spent more money on them. After a decline in 2023, the quantity of freshly purchased organic food increased by 5.5 percent in 2024 to a new record high of 260,600 tons, according to the RollAMA household panel. The purchase value rose by 3.7 percent to 1.1 billion euros. The number of organic farms decreased by 1,000 to 24,000 since 2022, according to the industry association Bio Austria.

Organic Farmers More Optimistic for This Year

The decline in organic farmers has many reasons, according to Bio Austria chairwoman Barbara Riegler, including less attractive conditions in the new EU agricultural funding period since 2023, farm transitions, retirements, and stricter rules for pasture management, Riegler said on Thursday at a press conference by AMA Marketing and Bio Austria at the Biofach fair in Nuremberg. Organic farmers are more optimistic for 2025. "A stabilizing trend can be seen in farm development," said the representative of the organic farmers.

Organic farming is a success story for farmers, food producers, and supermarkets in this country. With an organic farmer share of 23 percent in 2024 and an organic land share in agriculture of 27.3 percent, Austria is by far the leader in the EU and ranks second worldwide behind Liechtenstein. At the end of 2022, the Ministry of Agriculture, the Chamber of Agriculture, and Bio Austria set a goal with an "action program" to increase the organic area in Austria to 30 percent by 2027 and to 35 percent by 2030. To achieve this, the organic industry association demands more support from the future government and the new EU Commission.

Demand from Bio Austria Chairwoman

Better "political and economic conditions" are needed for organic farmers, demanded the Bio Austria chairwoman. "Environmental and climate services" of organic agriculture, which "are not reflected in the market," should be better covered by subsidies. "The consumer cannot pay for this."

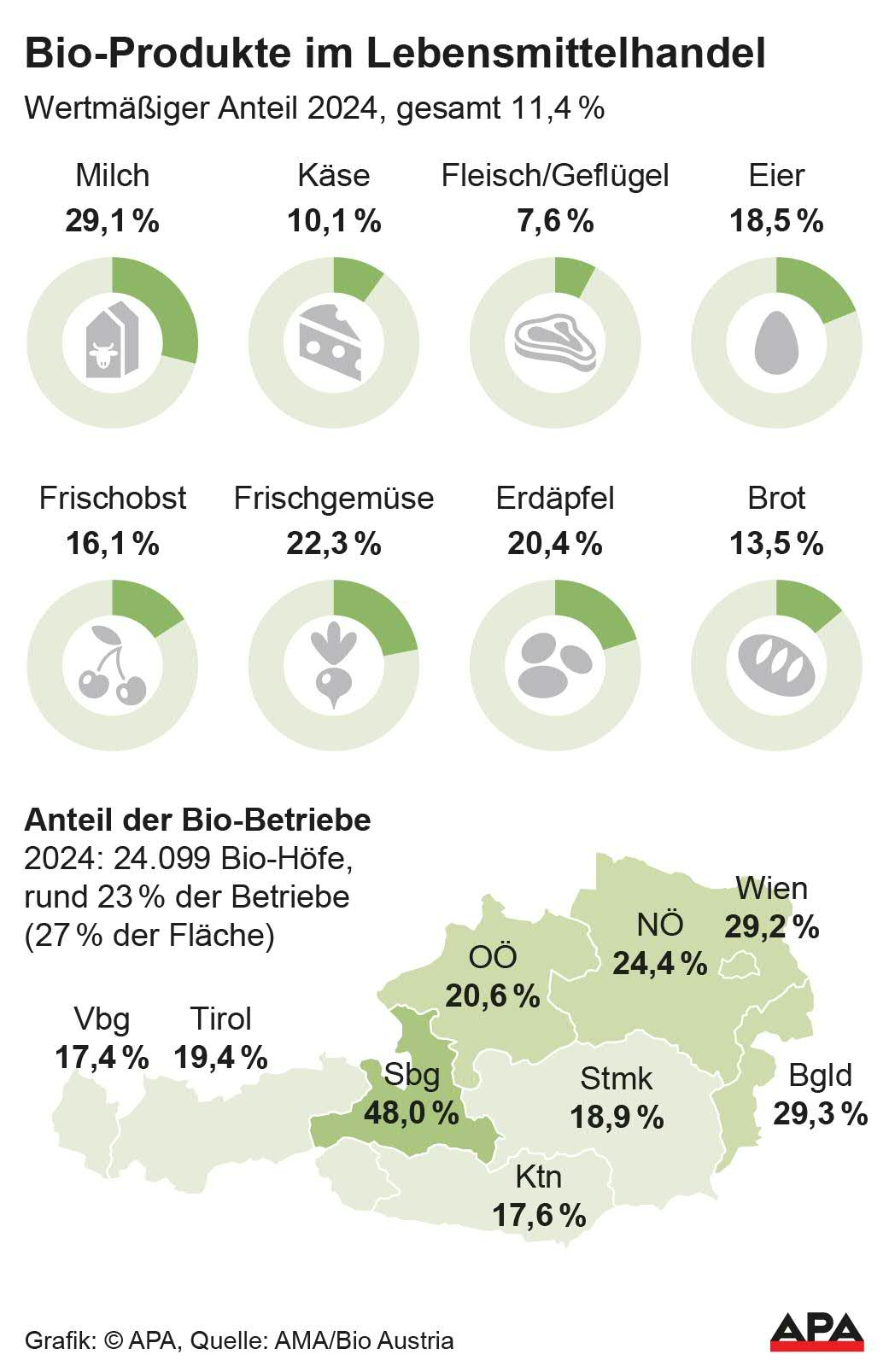

In organic farming, farmers refrain from using easily soluble mineral fertilizers and chemical-synthetic pesticides. Additionally, there must be a diverse crop rotation in arable farming and animal-friendly husbandry with access to the outdoors and grazing opportunities. The data from the so-called RollAMA survey showed an upward trend in organic products in many categories for 2024 after a sales "dip" in 2023. The share of fresh organic food in the grocery retail sector increased by 0.5 percentage points to 13 percent last year. "We are convinced that this trend will continue in the coming years," said AMA Marketing's organic marketing manager, Barbara Köcher-Schulz, at the Biofach fair. For the RollAMA, 2,800 Austrian households record their purchases in the grocery retail sector, including the discounters Hofer and Lidl.

Different Organic Shares

The value-based organic share is particularly high in domestic supermarkets for milk (29.1 percent), plant-based alternatives (28.2 percent), flour (26.1 percent), yogurt (23.8 percent), fresh vegetables (22.3 percent), and potatoes (20.4 percent). The organic share for meat increased by 0.7 percentage points to 7.6 percent last year, driven by many price promotions. "Organic meat is becoming increasingly important for consumers," said the AMA Marketing representative.

The major domestic supermarket chains dominate the local organic market with their private labels "Ja! Natürlich" (Adeg, Billa), "Natur*pur" (Spar), and "Zurück zum Ursprung" (Hofer). The revenue of Spar's private label "Natur*pur" grew by 8.3 percent in 2024 compared to the previous year, the supermarket chain stated in response to an APA inquiry without providing absolute sales figures. Spar offers over 6,000 organic products, of which 2,000 are private labels. The demand is "very good across the entire range, traditionally especially for the original products, such as fruits and vegetables, flours, dairy products." At Rewe (Adeg, Billa, Penny), the organic segment grew "in value and volume, as well as inflation-adjusted" in the previous year, it was stated to the APA. Baked goods, cooking oil, tropical fruits, poultry, meat alternatives, and beer have "particularly increased" and "boosted" organic sales. By the end of 2024, Rewe had over 4,000 organic products in its range in Austria, with around 1,400 attributed to the organic private labels "Ja! Natürlich" and "Billa Bio".

The discounter Hofer is "very satisfied" with the organic demand and the development of its private labels "Zurück zum Ursprung" and "BIO". Sales remain "stable" and there is "an upward trend in recent years," it was stated upon request. Hofer offers 700 items in organic quality. The introduction of organically and regionally produced mushrooms such as champignons or oyster mushrooms was "particularly successful" in 2024, according to the discounter.

Independent of the supermarkets, only the spice and tea specialist Sonnentor and the chocolate producer Zotter have been able to build their own larger organic brand. Sonnentor relies on franchise stores, the organic specialist trade, and pharmacies. In the 2024/25 fiscal year, Sonnentor's revenue is expected to increase by 5 percent to around 80 million euros, said Sonnentor owner Johannes Gutmann to journalists at the Biofach fair. Sonnentor has around 350 employees and plans to open more franchise locations in Austria and Germany. Zotter sells its chocolate mainly through small, specialized retailers, organic or natural food stores. The domestic dairies have not built large own organic brands but mainly produce for the organic private labels of the food trade.

Organic Fair with Nearly 70 Exhibitors from Austria

At the world's largest organic fair in Nuremberg, nearly 70 exhibitors from Austria gathered to attract new customers. Among those present were Agrana, Bio vom Berg, Höllinger, Juffinger, Kärntnermilch, SalzburgMilch, Sonnentor, and Woerle. Given the tough price competition in the concentrated food retail market in Austria and the small Austrian market, export is of essential importance for many food producers. The juice manufacturer Höllinger hopes for a sales boost abroad with its new sugar-free drinks and "urban drinks" (non-alcoholic Mojito, Aperitivo), including in the Middle East. The organic butcher Juffinger (revenue 11 million euros) is strongly rooted in Tyrol, but the German market is also an important sales market.

Two organic manufacturers with an Austrian connection were represented at the Biofach for the first time: The tofu producer New Originals, around Raiffeisen Upper Austria and the president of the organization Donau Soja, Matthias Krön, aims to create a European tofu player and presented new tofu creations at the fair. The company mainly produces private label tofu for many supermarket chains. So far, New Originals, based in Vienna, has purchased a tofu factory in Germany, Slovakia, and Romania. With 600 employees, they now produce 15,000 to 20,000 tons of tofu per year, Krön recently told the "Salzburger Nachrichten". The subsidiary of the Salzburg dietary supplement company Biogena, Biogena Alimentastic, presented its brand "Feel Food" at the Biofach fair. The vegan, organic instant meals in cups are currently heavily promoted in Austria and sold, among others, at Billa+. Only hot water is needed to prepare "Feel Food" (Chili sin carne, Thai Curry, Pasta Bolo, Lentil Dal).

Organic Catch-Up Potential Identified

Industry representatives have identified significant organic catch-up potential and growth opportunities for years in the domestic gastronomy, large kitchens, and canteens, as well as in public procurement. In a resolution, the turquoise-green government committed in 2021 to organic quotas for food purchased by the public sector, such as for schools, hospitals, or correctional facilities. For 2023, an organic share of 25 percent was planned, for 2025 it is 30 percent, and by 2030 it will be 55 percent. So far, the quotas have not been met by far, and the government has not been able to provide detailed figures.

Public sector food procurement is the "biggest lever" for the organic sector, said the Bio Austria chairwoman. "The Austrian legislator must create the framework conditions for organic purchasing," Riegler said towards the future government. The movement "Sustainable Austria" (ETÖ) is pushing for the early implementation of the organic quota "monitoring" promised in the action plan. ETÖ includes numerous organic farmers, entrepreneurs, researchers, associations, and organizations. The goal is "for the organic quotas to be visible and verifiable to achieve actual progress," it was stated to the APA. The corresponding data could be generated "without major complications" if the responsible bodies "show the necessary will."

(APA/Red)

This article has been automatically translated, read the original article here.